Common Corporate Tax Base (CC(C)TB) and Determination of Taxable Income: An International Comparison | SpringerLink

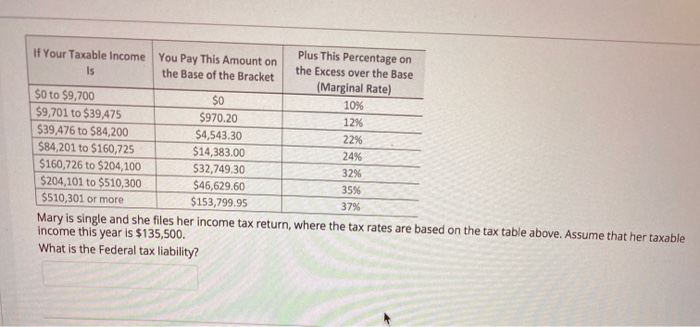

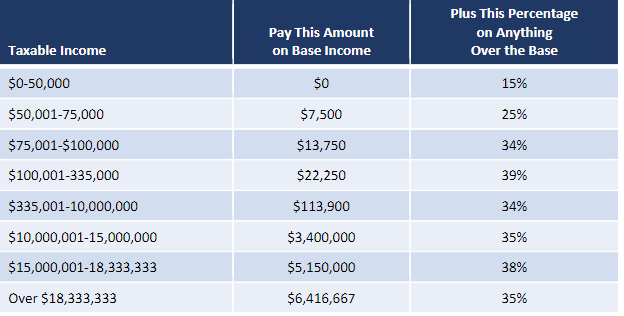

SOLVED: Corporations face the following tax schedule Percentage on Excess above Taxable Income Tax on Base of Bracket Base Up to S50,000 So 15% $50,000-$75,000 7,500 25 $75,000-$100,000 13,750 34 S100,000-S335,000 22,250

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

:max_bytes(150000):strip_icc()/averagecostbasismethod-final-5f03c63b554b46ea94b5f981bed3ec57.png)